DAILY MARKET REVIEW

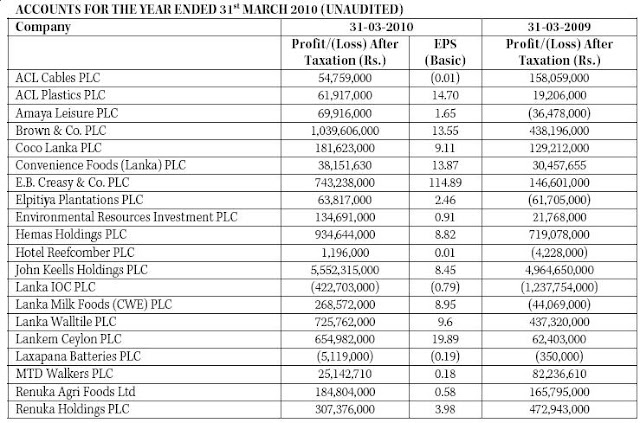

DAILY MARKET REVIEW31/05/2010 (S.L.S.Picks) - Colombo Stock Exchange was down today despite the improved quarterly results published by listed companies in Colombo Stock Exchange for the 1st quarter 2010, due to the continuous retail profit taking on a start of a fresh week of trading here in Sri Lanka.

All Share Price index was down 13.83 points to close at 4237.16 & Millanka Price index down by 3.95 points to close at 4757.40

Investor interest was focused to low valued shares such as Nawaloka, Dialog, Dankotuwa, Renuka Agri Foods, Glass, Mull, Reef, etc in during today’s trading session. A stake of 3.5m.n. Galadari hotel took place today @ Rs 34.00/share. Seller believes to be the Nawaloka Hospital.

Buying interest was visible in Dankotuwa porcelain & the share price appreciated by Rs 1.50 to close at Rs 18.50.

Hayleys which reported history best profits of Rs 2.6b.n for the financial year 2009 continuous to attract investor attention. The share was up by Rs 10.75 to close at Rs 305.00 on improved volumes.

Stores & Supplies sector was the highest gainer among all sectors today by registering a growth of 4.33% due to share price increase in Colombo Pharmacy Company, followed by the Construction & Engineering sector. IT sector was down by 5.74% was the leading negative growth sector.

Turnover reported for the day was a massive Rs1.2b.n

Foreign participation was at a low level. Foreigners purchased shares worth of Rs 202m.n & sold shares worth of Rs 231m.n reflecting a net foreign out flow of Rs 29m.n.

There were 64 gainers as against 83 losers for the day.

CLOSER LOOK

- Market was down due to the fact that the most of brokering firms were involved in debts clearing operations by the month end of May 31 2010.

- Sri Lanka is ready to host the IIFA awards ceremony in Colombo during the early parts of the month of June 2010, which will give the much needed boost & the confident to the investors.

- The crossings counter was filled with respected shares listed in Colombo Stock Exchange.

- All most all the Hotel sector companies reported improved results for the financial year 2009 ended 31/03/2010 & for the 1st Quarter 2010.

- John Keels Holdings - Sri Lanka's No 01 Diversified company reported 10% [YOY] profit increase for the financial year 2009.JKH share price was up by Rs 4.00 to close at Rs 184.00. Buying for JKH at improved price levels is always a positive sign for the overall market since JKH share price is more sensitive to ASI & MPI.

- We can see the buying building up for the future growth stocks & the arrival of bargain hunters to the market for the stocks such as Hemas Holdings, Lanka Ceramics etc.These two companies reported improved results for the year 2009 & for the 1st quarter 2010.

STOCKS TO WATCH

- Hemas Holdings - Why Hemas? see the report.

- Lanka Ceramics - Reported improved profits for the 2009 financial year ended 31/03/2010. Annual income for the year was Rs 936m.n an improvement of 117% YOY. EPS stands at Rs 14.18 for the year as at 31/03/2010.

- Seylan Bank X

No comments:

Post a Comment