Feb 29, 2012 (LBO) - Sri Lanka's stock closed up 0.49 percent Wednesday, with turnover boosted by the change of control of motor dealers, though market participants are still getting used to a new trading system, brokers said.

The Colombo All Share Index rose 0.49 percent to 5,458.09 points up 26.42 points while the Milanka Index of more liquid stocks rose 0.54 percent to 4,744.84 points.

Turnover rose to 1.6 billion rupees with a Sri Lanka's Access Engineering buying a 60 percent stake in Sathosa Motors from Japan's Itochu Corp for 846 million rupees paying 235 rupees a share.

Brokers said they were still getting used to a new automated trading system upgrade at the Colombo Stock Exchange which was keeping transaction volumes down.

With the so-called 'odd lots' board no longer in place and all stocks going through the main board single shares were being traded at high prices.

Ceylon Tea Services rose 58.10 rupees to 599.0 rupees and EB Creasy and Company rose 249.40 rupees to 1,000 rupees.

However a stock exchange spokesman said trades below 100 shares were not included in the index. Under the earlier system odd lots used to trade to a discount to the main board.

Commercial Bank rose 10 cents to 100.10 rupees, Hatton National Bank was flat at 150 rupees, and Sampath rose 0.91 cents to close at 185.91 rupees.

Many banks have reported higher profits largely on lower tax charges but their core banking profits were squeezed on rising interest rates.

Bukit Darah, an index heavy stock rose 28.80 rupees to close at 980.00 rupees Sri Lanka Telecom rose 70 cents to 45.80 rupees.

source - www.lbo.lk

Sri Lanka stock picks site has been developed to give first hand information with regard to share trading opportunities available for investors who do not like go through lengthy research reports, calculations,etc but to have a clear idea about stocks that have future up side potential.Our service is just not for day traders but for the investors who wish to see their money growing in the long run.Our main objective is to provide information relating to trading under one roof.

Wednesday, February 29, 2012

Sri Lanka Access Engineering buys control of Sathosa Motors

Feb 29, 2012 (LBO) - Sri Lanka's Access Engineering bought 60 percent of vehicle importer Sathosa Motors from Japan's Itochu Corp. for 846 million rupees paying 235 rupees a share, its chairman Sumal Perera said.

He said the acquisition would be a good fit to the group's existing business which is expanding.

"In addition to organic growth, we were looking at any good strategic investment opportunity," he told LBO.

"We believe there will be steady growth in the commercial vehicle and construction machinery business in the coming years."

Access Engineering plans an initial public offer opening on March 6 of 20 million shares at 25 rupees each to raise 500 million rupees.

Perera said in June 2011, the firm raised 4.5 billion rupees in a private placement of shares at the same price.

The acquisition of Sathosa Motors would also provide Access Engineering access to the Sathosa Motor's vehicle workshop, Perera said.

"There will also b synergies with the workshop. We have increased our company's plant and machinery and we need a very good workshop to maintain them. Also, there is the Isuzu brand name."

Perera said Itochu Corp wanted to exit from Sathosa Motors and selected Access after evaluating a few candidates.

"Itochu is a very large Japanese trading company. They felt they needed a good local partner to go forward and focus on the business and after evaluating a few candidates they selected us," Perera said.

"But they will continue to be our trading partner in Japan in shipping, Isuzu vehicles and spares."

source - www.lbo.lk

He said the acquisition would be a good fit to the group's existing business which is expanding.

"In addition to organic growth, we were looking at any good strategic investment opportunity," he told LBO.

"We believe there will be steady growth in the commercial vehicle and construction machinery business in the coming years."

Access Engineering plans an initial public offer opening on March 6 of 20 million shares at 25 rupees each to raise 500 million rupees.

Perera said in June 2011, the firm raised 4.5 billion rupees in a private placement of shares at the same price.

The acquisition of Sathosa Motors would also provide Access Engineering access to the Sathosa Motor's vehicle workshop, Perera said.

"There will also b synergies with the workshop. We have increased our company's plant and machinery and we need a very good workshop to maintain them. Also, there is the Isuzu brand name."

Perera said Itochu Corp wanted to exit from Sathosa Motors and selected Access after evaluating a few candidates.

"Itochu is a very large Japanese trading company. They felt they needed a good local partner to go forward and focus on the business and after evaluating a few candidates they selected us," Perera said.

"But they will continue to be our trading partner in Japan in shipping, Isuzu vehicles and spares."

source - www.lbo.lk

Harry’s Melstacorp buys 11% more in Spence for Rs. 5 b

SLIC books hefty Rs. 4 b capital gain as an eager Harry secures large block

Ups control to 40.8%

Melstacorp to revise Spence mandatory offer price to Rs. 115 per share from Rs. 113

Business tycoon Harry Jayawardena-linked Melstacorp Ltd. yesterday acquired a strategic block of an 11% stake in Aitken Spence Plc for Rs. 5 billion, paying a price above that of the ongoing mandatory offer.

Melstacorp, a fully-owned subsidiary of Distilleries Company, bought a 10.8% stake or 44.03 million shares at Rs. 115 each (Rs. 2.17 above the mandatory offer price of Rs. 112.83) in a deal worth Rs. 5.06 billion from Sri Lanka Insurance Corporation (SLIC).

Analysts said the above mandatory offer price suggests that Harry was eager to clinch SLIC’s stake, which incidentally was acquired when the Distilleries-involved consortium owned and managed the insurance giant.

Some estimated that the actual cost for SLIC was around Rs. 18 to 20 per share, which means it booked around Rs. 4 billion profit from the sale. SLIC held the stake via General fund (6.4%) and Life fund (4.43%).

With yesterday’s acquisition, Harry now controls around 40.8% stake in Spence. The next remaining block is a 7% stake held by EPF. The control is via Distilleries (28%) and Milford Exports along with Stassen Exports (2%) in addition to Melstacorp’s 11% acquired yesterday.

Net asset per share of Spence at Company level is Rs. 23.66 and at Group level it is Rs. 57. Spence’s forward PE is 13 times and price to book value is two times.

The buy by Melstacorp however was in line with current market price. Spence closed last week at Rs. 116, up by Rs. 2 from the previous week. Yesterday it began trading at Rs. 119.90 (intra-day highest) whilst prior to the mega crossing of 44 million shares, a few blocks went at Rs.115 level before closing at Rs. 115.50.

As exclusively reported by the Daily FT on Monday, foreign funds have of late stepped up buying into Aitken Spence. They picked up a 1% stake for Rs. 516 million last week.

Distilleries at company level had revenue reserves of Rs. 25 billion as at 31 December 2011, up from 21.7 billion as at March 2011 and Rs. 16.8 billion as at December 2010. Its recent major investment (via Melstacorp) was a 3.2% stake in JKH, currently worth Rs. 4.76 billion.

Last week Melstacorp acquired a 9% stake in Lanka Milk Foods for Rs. 350 million, thereby increasing Harry’s control to 52% and a mandatory offer is pending.

source - www.ft.lk

Ups control to 40.8%

Melstacorp to revise Spence mandatory offer price to Rs. 115 per share from Rs. 113

Business tycoon Harry Jayawardena-linked Melstacorp Ltd. yesterday acquired a strategic block of an 11% stake in Aitken Spence Plc for Rs. 5 billion, paying a price above that of the ongoing mandatory offer.

Melstacorp, a fully-owned subsidiary of Distilleries Company, bought a 10.8% stake or 44.03 million shares at Rs. 115 each (Rs. 2.17 above the mandatory offer price of Rs. 112.83) in a deal worth Rs. 5.06 billion from Sri Lanka Insurance Corporation (SLIC).

Analysts said the above mandatory offer price suggests that Harry was eager to clinch SLIC’s stake, which incidentally was acquired when the Distilleries-involved consortium owned and managed the insurance giant.

Some estimated that the actual cost for SLIC was around Rs. 18 to 20 per share, which means it booked around Rs. 4 billion profit from the sale. SLIC held the stake via General fund (6.4%) and Life fund (4.43%).

With yesterday’s acquisition, Harry now controls around 40.8% stake in Spence. The next remaining block is a 7% stake held by EPF. The control is via Distilleries (28%) and Milford Exports along with Stassen Exports (2%) in addition to Melstacorp’s 11% acquired yesterday.

Net asset per share of Spence at Company level is Rs. 23.66 and at Group level it is Rs. 57. Spence’s forward PE is 13 times and price to book value is two times.

The buy by Melstacorp however was in line with current market price. Spence closed last week at Rs. 116, up by Rs. 2 from the previous week. Yesterday it began trading at Rs. 119.90 (intra-day highest) whilst prior to the mega crossing of 44 million shares, a few blocks went at Rs.115 level before closing at Rs. 115.50.

As exclusively reported by the Daily FT on Monday, foreign funds have of late stepped up buying into Aitken Spence. They picked up a 1% stake for Rs. 516 million last week.

Distilleries at company level had revenue reserves of Rs. 25 billion as at 31 December 2011, up from 21.7 billion as at March 2011 and Rs. 16.8 billion as at December 2010. Its recent major investment (via Melstacorp) was a 3.2% stake in JKH, currently worth Rs. 4.76 billion.

Last week Melstacorp acquired a 9% stake in Lanka Milk Foods for Rs. 350 million, thereby increasing Harry’s control to 52% and a mandatory offer is pending.

source - www.ft.lk

Pasan Madanayake buys 20% stake in ASCOT for Rs. 368 m

Engineer turned entrepreneur Pasan Madanayake yesterday bought a strategic 20% stake in ASCOT Holdings for Rs. 368 million.

The purchase was via his newly-floated firm St. Louis Capital Ltd. Yesterday 1.85 million shares of ASCOT amounting to a 23% stake traded for Rs. 411 million.

Pasan had picked up the biggest block of 1.6 million shares (20.1% stake) that traded at Rs. 225 each in addition to a few more in a deal worth Rs. 368 million.

ASCOT figured in the top 10 gainers percentagewise as its share price closed up 16% or Rs. 28.60 to close at Rs. 206.40 whilst it hit an intra-day high of Rs. 225. The 1.85 million share volume saw 413 trades.

Pasan owns Amtrad, the leader in cement pavings and blocks, as well as Lanka Quarries, also a leader in its field.

Analysts viewed the investment as strategic as there were speculation that Pasan could be looking for synergies between ASCOT and his two companies.

The seller of the block was Rohan Iriyagolle, who previously controlled a 42% stake via Axis Financial Services. Following the sale, his stake has come down to 21%. The other major shareholder of ASCOT Holdings is Nimal Perera with a stake of 20%.

Nimal crossed the 20% threshold in January when he bought a 3.3% stake or 0.26 million shares at Rs. 150 level.

source - www.ft.lk

The purchase was via his newly-floated firm St. Louis Capital Ltd. Yesterday 1.85 million shares of ASCOT amounting to a 23% stake traded for Rs. 411 million.

Pasan had picked up the biggest block of 1.6 million shares (20.1% stake) that traded at Rs. 225 each in addition to a few more in a deal worth Rs. 368 million.

ASCOT figured in the top 10 gainers percentagewise as its share price closed up 16% or Rs. 28.60 to close at Rs. 206.40 whilst it hit an intra-day high of Rs. 225. The 1.85 million share volume saw 413 trades.

Pasan owns Amtrad, the leader in cement pavings and blocks, as well as Lanka Quarries, also a leader in its field.

Analysts viewed the investment as strategic as there were speculation that Pasan could be looking for synergies between ASCOT and his two companies.

The seller of the block was Rohan Iriyagolle, who previously controlled a 42% stake via Axis Financial Services. Following the sale, his stake has come down to 21%. The other major shareholder of ASCOT Holdings is Nimal Perera with a stake of 20%.

Nimal crossed the 20% threshold in January when he bought a 3.3% stake or 0.26 million shares at Rs. 150 level.

source - www.ft.lk

COMBank breaks Rs. 10 b barrier in pre-tax profit

Commercial Bank of Ceylon PLC has achieved outstanding growth in key performance indicators to post record profit and operational growth in 2011 and end the year once again as the benchmark private bank in the country.

According to income statements released to the Colombo Stock Exchange for the 12 months ending 31 December 2011, Commercial Bank exceeded Rs. 10 billion in profit before corporate tax, reaching a new milestone by growing PBT by 17.9% to Rs 10.987 billion in the review period.

Profit after tax grew by a robust 45.7% to reach Rs. 8 billion (Rs. 8.047 billion) from Rs. 5.523 billion for the previous year.

The bank’s total income for the year was up 9.54% to Rs. 45.483 billion, with interest income growing by Rs. 2.9 billion to Rs. 37.639 billion and non-interest income (foreign exchange and other income) growing by 16% to Rs. 6.590 billion. Net interest income increased by 9.66% to Rs. 17.996 billion. Net income improved by 11.3% to Rs. 24.586 billion.

The total interest income growth was principally attributable to a healthy 21.59% growth in interest income from loans and advances, which amounted to Rs. 28.697 billion for the 12 months. Interest income from other interest earning assets such as Treasury Bills and Bonds totalled Rs. 8.942 billion reflecting a decline of Rs. 2.195 billion or 19.7%.

This was due to the reduction in bills and bonds volume and the lower interest regime that prevailed in the review period.

Gross loans and advances grew by Rs. 59.590 billion over the 12 months to Rs. 287.96 billion at 31 December 2011, an increase that averaged Rs. 5 billion per month. The total performing loans and advances portfolio of the bank expanded by a noteworthy 27.50% to Rs. 272.135 billion.

Total deposits of the bank as at 31 December 2011 stood at Rs. 318.461 billion, an increase of Rs. 58.682 billion or 22.59% over 12 months. The average growth in deposits was also close to Rs. 5 billion per month.

On the strength of these results, the Board of Directors of Commercial Bank has proposed a final dividend of Rs. 3.50 per share, made up of Rs. 1.50 in cash and Rs. 2 in the form of a scrip dividend, taking total dividend per share for the year to Rs. 6. The bank paid an interim dividend of Rs. 2.50 earlier in the year. These dividends are on the higher capital after a Rights Issue in August and a 1 for 1 Share Split in September 2011.

Commercial Bank Managing Director Amitha Gooneratne described the bank’s performance as the result of solid all-round contributions from all core areas of banking. “Our focus has always been on optimising the operational returns whilst maintaining a healthy balance in the deposit mix and prudent lending,” Gooneratne said.

He said the bank had, as a result, maintained or improved key performance ratios.

Gooneratne also disclosed that the bank had been able to transfer Rs. 1.194 billion to an investment fund account from the tax savings, resulting from a reduction in the tax rate from 35% to 28% and the reduction in the financial VAT rate from 20% to 12%.

Total assets of the bank grew by Rs. 71 billion or 19.2% to Rs. 441 billion as at 31 December 2011.

The bank opened 26 new delivery channels and installed 100 new ATMs in Sri Lanka during the review period, to end the year with 213 service points and a network of 500 ATMs, which is the largest ATM network operated by a bank in the country. The bank’s Bangladesh operations comprise of 17 service points and 14 ATMs.

Specific provisions increased by 92.3% to Rs. 1.979 billion. The impact of this increase was, however, partly offset by a net reversal of statutory general provisions on performing and overdue loans due to the Central Bank’s decision to reduce general provisions to 0.5% from 0.9% at the beginning of the year. As a result, net provisions for bad and doubtful debts increased by Rs 151 million to Rs. 235.2 million.

The gross NPL ratio (net of interest in suspense) reduced from 4.22% at end 2010 to 3.43% at 31 December 2011, while net NPL ratio came down to 2.08% from 2.78% a year previously. With the additional specific provisions made on a prudential basis during the year, gross provision cover improved to 34.07% by the end of the year, Commercial Bank Chief Financial Officer Nandika Buddhipala commented. Net provision cover (provisions made as a percentage of net non-performing loans) improved to 39.53%.

Commercial Bank’s open credit exposure ratio (ratio of net non-performing loans to capital) also recorded a significant improvement, from 18.61% in 2010 to 14.26% in the year reviewed. Net exposure came down as a result of the additional provisions and the increase in the capital base following the bank’s rights issue, Buddhipala explained.

Interest expenses rose by 7.17% to Rs. 19.643 billion, mainly due to increase in deposit volume during the year. Non-interest expenses grew by 18.66% to Rs. 11.841 billion, primarily on account of increased expenses linked to the expansion of the bank’s delivery channels in Sri Lanka and Bangladesh. One of the significant contributors to operating expenses was the full-year impact of the deposit insurance scheme mandated by the Central Bank of Sri Lanka, he said.

In other key performance ratios, the bank’s basic earnings per share improved by 39.06% to Rs. 10.04; return on equity improved to 20.76% from 17.87% last year and return on assets reached 2.71% from 2.69% last year. Market capitalisation as at 30 December 2011 was Rs. 76.508 billion, the highest among listed banks and the sixth highest among all listed entities in Sri Lanka.

The bank also improved its total capital adequacy ratio to 13.01% from 12.27% a year previously.

Taken as a Group, the Commercial Bank, its subsidiaries and associates posted pre-tax profit of Rs. 11.068 billion at the end of 2011, recording a growth of 19%. Profit after tax for the period was up 47% to Rs. 8.095 billion.

Commercial Bank is the largest private bank in Sri Lanka, and the only Sri Lankan bank listed in the world’s Top 1,000 Banks. It operates a network of 213 service points in Sri Lanka and a network of 500 ATMs, the single largest ATM network operated by a bank in the island.

The bank has been adjudged ‘Best Bank in Sri Lanka’ for 13 consecutive years by ‘Global Finance’ Magazine and has won multiple awards as the country’s best bank from ‘The Banker,’ ‘FinanceAsia,’ ‘Euromoney’ and ‘Trade Finance’ magazines.

source - www.ft.lk

According to income statements released to the Colombo Stock Exchange for the 12 months ending 31 December 2011, Commercial Bank exceeded Rs. 10 billion in profit before corporate tax, reaching a new milestone by growing PBT by 17.9% to Rs 10.987 billion in the review period.

Profit after tax grew by a robust 45.7% to reach Rs. 8 billion (Rs. 8.047 billion) from Rs. 5.523 billion for the previous year.

The bank’s total income for the year was up 9.54% to Rs. 45.483 billion, with interest income growing by Rs. 2.9 billion to Rs. 37.639 billion and non-interest income (foreign exchange and other income) growing by 16% to Rs. 6.590 billion. Net interest income increased by 9.66% to Rs. 17.996 billion. Net income improved by 11.3% to Rs. 24.586 billion.

The total interest income growth was principally attributable to a healthy 21.59% growth in interest income from loans and advances, which amounted to Rs. 28.697 billion for the 12 months. Interest income from other interest earning assets such as Treasury Bills and Bonds totalled Rs. 8.942 billion reflecting a decline of Rs. 2.195 billion or 19.7%.

This was due to the reduction in bills and bonds volume and the lower interest regime that prevailed in the review period.

Gross loans and advances grew by Rs. 59.590 billion over the 12 months to Rs. 287.96 billion at 31 December 2011, an increase that averaged Rs. 5 billion per month. The total performing loans and advances portfolio of the bank expanded by a noteworthy 27.50% to Rs. 272.135 billion.

Total deposits of the bank as at 31 December 2011 stood at Rs. 318.461 billion, an increase of Rs. 58.682 billion or 22.59% over 12 months. The average growth in deposits was also close to Rs. 5 billion per month.

On the strength of these results, the Board of Directors of Commercial Bank has proposed a final dividend of Rs. 3.50 per share, made up of Rs. 1.50 in cash and Rs. 2 in the form of a scrip dividend, taking total dividend per share for the year to Rs. 6. The bank paid an interim dividend of Rs. 2.50 earlier in the year. These dividends are on the higher capital after a Rights Issue in August and a 1 for 1 Share Split in September 2011.

Commercial Bank Managing Director Amitha Gooneratne described the bank’s performance as the result of solid all-round contributions from all core areas of banking. “Our focus has always been on optimising the operational returns whilst maintaining a healthy balance in the deposit mix and prudent lending,” Gooneratne said.

He said the bank had, as a result, maintained or improved key performance ratios.

Gooneratne also disclosed that the bank had been able to transfer Rs. 1.194 billion to an investment fund account from the tax savings, resulting from a reduction in the tax rate from 35% to 28% and the reduction in the financial VAT rate from 20% to 12%.

Total assets of the bank grew by Rs. 71 billion or 19.2% to Rs. 441 billion as at 31 December 2011.

The bank opened 26 new delivery channels and installed 100 new ATMs in Sri Lanka during the review period, to end the year with 213 service points and a network of 500 ATMs, which is the largest ATM network operated by a bank in the country. The bank’s Bangladesh operations comprise of 17 service points and 14 ATMs.

Specific provisions increased by 92.3% to Rs. 1.979 billion. The impact of this increase was, however, partly offset by a net reversal of statutory general provisions on performing and overdue loans due to the Central Bank’s decision to reduce general provisions to 0.5% from 0.9% at the beginning of the year. As a result, net provisions for bad and doubtful debts increased by Rs 151 million to Rs. 235.2 million.

The gross NPL ratio (net of interest in suspense) reduced from 4.22% at end 2010 to 3.43% at 31 December 2011, while net NPL ratio came down to 2.08% from 2.78% a year previously. With the additional specific provisions made on a prudential basis during the year, gross provision cover improved to 34.07% by the end of the year, Commercial Bank Chief Financial Officer Nandika Buddhipala commented. Net provision cover (provisions made as a percentage of net non-performing loans) improved to 39.53%.

Commercial Bank’s open credit exposure ratio (ratio of net non-performing loans to capital) also recorded a significant improvement, from 18.61% in 2010 to 14.26% in the year reviewed. Net exposure came down as a result of the additional provisions and the increase in the capital base following the bank’s rights issue, Buddhipala explained.

Interest expenses rose by 7.17% to Rs. 19.643 billion, mainly due to increase in deposit volume during the year. Non-interest expenses grew by 18.66% to Rs. 11.841 billion, primarily on account of increased expenses linked to the expansion of the bank’s delivery channels in Sri Lanka and Bangladesh. One of the significant contributors to operating expenses was the full-year impact of the deposit insurance scheme mandated by the Central Bank of Sri Lanka, he said.

In other key performance ratios, the bank’s basic earnings per share improved by 39.06% to Rs. 10.04; return on equity improved to 20.76% from 17.87% last year and return on assets reached 2.71% from 2.69% last year. Market capitalisation as at 30 December 2011 was Rs. 76.508 billion, the highest among listed banks and the sixth highest among all listed entities in Sri Lanka.

The bank also improved its total capital adequacy ratio to 13.01% from 12.27% a year previously.

Taken as a Group, the Commercial Bank, its subsidiaries and associates posted pre-tax profit of Rs. 11.068 billion at the end of 2011, recording a growth of 19%. Profit after tax for the period was up 47% to Rs. 8.095 billion.

Commercial Bank is the largest private bank in Sri Lanka, and the only Sri Lankan bank listed in the world’s Top 1,000 Banks. It operates a network of 213 service points in Sri Lanka and a network of 500 ATMs, the single largest ATM network operated by a bank in the island.

The bank has been adjudged ‘Best Bank in Sri Lanka’ for 13 consecutive years by ‘Global Finance’ Magazine and has won multiple awards as the country’s best bank from ‘The Banker,’ ‘FinanceAsia,’ ‘Euromoney’ and ‘Trade Finance’ magazines.

source - www.ft.lk

Broker battle for big deal

Given its sheer size, the deal involving SLIC and Melstacorp on Spence had its share of broker battle as well, the Daily FT learns.

There had been several brokers who either showed the quantity in full or parts or were firming up already. Some had been asked for a higher price by the seller as well.

However, akin to a directive from the sky, the deal was eventually done on a shared basis between Sommerville and John Keells Stock Brokers, much to the chagrin of those who sweated previously or almost had the deal.

Spence trades were done via two blocks – 26 million shares and 18 million shares each with JKSB as the buying broker and Sommerville doing the selling.

source - www.ft.lk

There had been several brokers who either showed the quantity in full or parts or were firming up already. Some had been asked for a higher price by the seller as well.

However, akin to a directive from the sky, the deal was eventually done on a shared basis between Sommerville and John Keells Stock Brokers, much to the chagrin of those who sweated previously or almost had the deal.

Spence trades were done via two blocks – 26 million shares and 18 million shares each with JKSB as the buying broker and Sommerville doing the selling.

source - www.ft.lk

HNB ups Group net profit by 27.6% to Rs. 6.2 b in 2011

Hatton National Bank (HNB) revealed yesterday that it has made a Rs. 6.2 billion consolidated profit after tax for the year 2011.

In a statement, HNB said the financial year 2011 presented a set of new challenges for the banking sector, different from those it witnessed during the previous two years. In 2011 the banking sector experienced an unprecedented growth in demand for credit, recording a 32% growth in loans and advances compared to 24% in 2010.

The bigger challenge for the banking sector, however, was to manage its liquidity as the deposits witnessed only a 19% growth during the year. In addition, the healthy margins enjoyed by the industry in the past came under persistent pressure with interest rates remaining close to single digit for the major part of 2011.

Despite the challenges faced, the bank recorded strong results in 2011 and Chairperson Dr. Ranee Jayamaha commented: “In 2011, we stood strong and tall for our clients, depositors and shareholders in an uncertain world. Our passion to perform and fresh thinking helped deliver business solutions that met our client-specific commercial needs across the entirety of the branch network last year, with no compromise on quality, building lasting and fulfilling relationships with customers from all walks of life.”

During the financial year 2011, the bank’s interest income recorded a growth of 9.6% due to rapid growth in loans and advances, compared to the negative growth witnessed in 2010. However growth in interest income did not keep pace with the increase in loans and advances, demonstrating a drop in yields compared to 2010.

However, interest cost in 2011 increased by 13.9% during the same period, despite deposits growing at a slower pace than advances. Hence the bank’s net interest margin narrowed in 2011. This was an industry-wide phenomenon witnessed during the financial year. Accordingly, the net interest income of the bank grew by 5.5% in 2011 compared to 2010.

The bank was successful in growing its commission income base by more than 32% during the year with trade income and card commissions leading the way. However exchange income witnessed a setback during 2011 due to relatively stable exchange rates for the most part of the year.

A significant drop of 49.9% was noted in other income due to the absence of capital gains realised in 2010 from the disposal of investments in Commercial Bank of Ceylon PLC, Distilleries Company of Sri Lanka PLC, Acuity Securities (Pvt) Ltd. and Lanka Ventures PLC and the marked to market gains recorded from equity investments in the previous year. However, the dividend income increased by Rs. 200 m as a result of higher dividend declared by DFCC.

Accordingly, the net income of the bank for 2011 stood at Rs. 21.2 billion, which is a 5.2% growth from the previous year.

During the year the bank focused on capacity building by opening 35 new customer centres, which is by far the most aggressive network expansion during the past decade.

Commenting on the expansion drive, HNB Managing Director and CEO Rajendra Theagarajah stated: “In 2011, our focus was essentially to further penetrate the rural sector, and as such we followed a concerted strategy of network penetration with a view to not only enhance our footprint across the Island but also to bring the concept of banking to the very doorsteps of every rural community. Our initiatives towards absorbing individuals even at the lowest tier of the socioeconomic group have opened vistas of opportunities to communities who have for generations lived beyond the poverty line.”

Despite the said expansion, focus on rationalisation of cost continued to be a priority during 2011 and the bank managed to maintain the increase in staff emoluments at a modest 5% while other expenses increased by 10% during the year.

However, the increased contribution towards the deposit insurance scheme introduced in late 2010 and marked to market losses of the equity portfolio included under other expenses further contributed towards increasing the cost base compared to the previous year. This, coupled with the lower growth in net income, has caused the cost to income ratio to deteriorate to 57.7% compared to 54.9% last year.

The bank continued its recovery efforts to bring the gross NPA ratio below 4% in 2011 and accordingly, the gross NPA ratio stood at 3.9% compared to 4.5% last year. However, the net NPA witnessed a marginal increase to 2.3% from 1.95% in 2010 mainly due to the 0.5% reversal of the general provision as per Central Bank guidelines as a precursor to the introduction of fair value accounting in 2012.

The industry witnessed the benefit of a lower tax regime in 2011, as the Government Budget proposals in 2010 announced significant reductions in corporate tax rates applicable for banks. Accordingly, the corporate tax charge for HNB dropped by 3.1% reflecting an effective tax rate of 28.3% compared to 33.7% in 2010.

In 2011, HNB managed to grow its pre-tax profits by 15.4% to Rs. 7.8 billion compared to the previous year, while the Group posted a pre-tax profit of Rs. 8.5 billion, recording a growth of 17%.

The net profit after tax for the bank stood at Rs. 5.6 billion, recording a growth of 24.8 % in 2011 despite pressure on margins and significant reduction in investment income as explained above. The Group net profit for 2011 amounted to Rs. 6.2 billion, which represents a year-on-year growth of 27.6%.

The bank’s return on average assets stood at 1.6% compared to 1.5% in the previous year and return on average equity was maintained at 17.3% in 2011 despite the equity infusion.

In 2011, the bank’s asset base grew by a significant 20.4% funded by an infusion of capital as well as a steady growth of its deposit base. Contrary to the previous two years, the loan book of the bank grew by a staggering 25.8% to Rs. 264.3 b. The growth was supported by all segments including corporate, SME, leasing, pawning and retail aided by the bank’s customer centre network spread across the country. The network expansion during the year, especially in the previous war torn regions too contributed towards this end.

Though the bank witnessed a robust growth in deposits of 21.4%, it did not keep pace with loans and advances. The current account base for the bank showed a drop from the previous year, mainly due to the withdrawal of a large deposit which came in for a short period of time during the last week of 2010.

The savings deposit base witnessed a healthy growth during the year despite increasing interest rates towards the latter part of the year adding pressure on low cost deposits. The rupee fixed deposits during the year witnessed a sizable growth of 45% to Rs. 113.3 b in 2011. Accordingly, the Current Account and Savings Account (CASA) ratio dropped from 56% in 2010 to 49% in 2011.

The bank paid an interim dividend of Rs. 1.50 per share for 2011 in December and proposes a final dividend of Rs. 6 per share. The final dividend consists of cash dividend of Rs. 3 per share and a scrip dividend of Rs. 3 per share. The gross dividend for the year increased by 76.7% to Rs. 2,914 million on account of the total dividend payment of Rs. 7.50 per share against the total gross dividend payment for 2010.

During the year the bank raised Rs. 6.1 billion by way of a rights issue while the tier II capital base was strengthened through a subordinated debt issue of Rs. 2 billion during the year. As a result, the capital adequacy ratios remained healthy with core capital ratio at 12.76% and total capital adequacy ratio at 14.51% as at the end of December 2011.

The Group companies recorded commendable contributions during 2011, with HNB Assurance PLC, the insurance subsidiary, posting a 24% growth in gross written premium and 14% growth in post-tax profits to reach Rs. 275 million.

Sithma Development Limited, the property development subsidiary, recorded outstanding performance in 2011, posting a growth of 60% in post-tax profit, while Acuity Partners (Pvt) Ltd., the joint venture investment bank, posted commendable results despite sluggish market conditions that prevailed during most part of the year.

The Acuity Group further consolidated its position as the full service investment bank in the country through the asset management arm that was set up during the year, in collaboration with Ceylon Guardian Investments PLC.

source - www.ft.lk

In a statement, HNB said the financial year 2011 presented a set of new challenges for the banking sector, different from those it witnessed during the previous two years. In 2011 the banking sector experienced an unprecedented growth in demand for credit, recording a 32% growth in loans and advances compared to 24% in 2010.

The bigger challenge for the banking sector, however, was to manage its liquidity as the deposits witnessed only a 19% growth during the year. In addition, the healthy margins enjoyed by the industry in the past came under persistent pressure with interest rates remaining close to single digit for the major part of 2011.

Despite the challenges faced, the bank recorded strong results in 2011 and Chairperson Dr. Ranee Jayamaha commented: “In 2011, we stood strong and tall for our clients, depositors and shareholders in an uncertain world. Our passion to perform and fresh thinking helped deliver business solutions that met our client-specific commercial needs across the entirety of the branch network last year, with no compromise on quality, building lasting and fulfilling relationships with customers from all walks of life.”

During the financial year 2011, the bank’s interest income recorded a growth of 9.6% due to rapid growth in loans and advances, compared to the negative growth witnessed in 2010. However growth in interest income did not keep pace with the increase in loans and advances, demonstrating a drop in yields compared to 2010.

However, interest cost in 2011 increased by 13.9% during the same period, despite deposits growing at a slower pace than advances. Hence the bank’s net interest margin narrowed in 2011. This was an industry-wide phenomenon witnessed during the financial year. Accordingly, the net interest income of the bank grew by 5.5% in 2011 compared to 2010.

The bank was successful in growing its commission income base by more than 32% during the year with trade income and card commissions leading the way. However exchange income witnessed a setback during 2011 due to relatively stable exchange rates for the most part of the year.

A significant drop of 49.9% was noted in other income due to the absence of capital gains realised in 2010 from the disposal of investments in Commercial Bank of Ceylon PLC, Distilleries Company of Sri Lanka PLC, Acuity Securities (Pvt) Ltd. and Lanka Ventures PLC and the marked to market gains recorded from equity investments in the previous year. However, the dividend income increased by Rs. 200 m as a result of higher dividend declared by DFCC.

Accordingly, the net income of the bank for 2011 stood at Rs. 21.2 billion, which is a 5.2% growth from the previous year.

During the year the bank focused on capacity building by opening 35 new customer centres, which is by far the most aggressive network expansion during the past decade.

Commenting on the expansion drive, HNB Managing Director and CEO Rajendra Theagarajah stated: “In 2011, our focus was essentially to further penetrate the rural sector, and as such we followed a concerted strategy of network penetration with a view to not only enhance our footprint across the Island but also to bring the concept of banking to the very doorsteps of every rural community. Our initiatives towards absorbing individuals even at the lowest tier of the socioeconomic group have opened vistas of opportunities to communities who have for generations lived beyond the poverty line.”

Despite the said expansion, focus on rationalisation of cost continued to be a priority during 2011 and the bank managed to maintain the increase in staff emoluments at a modest 5% while other expenses increased by 10% during the year.

However, the increased contribution towards the deposit insurance scheme introduced in late 2010 and marked to market losses of the equity portfolio included under other expenses further contributed towards increasing the cost base compared to the previous year. This, coupled with the lower growth in net income, has caused the cost to income ratio to deteriorate to 57.7% compared to 54.9% last year.

The bank continued its recovery efforts to bring the gross NPA ratio below 4% in 2011 and accordingly, the gross NPA ratio stood at 3.9% compared to 4.5% last year. However, the net NPA witnessed a marginal increase to 2.3% from 1.95% in 2010 mainly due to the 0.5% reversal of the general provision as per Central Bank guidelines as a precursor to the introduction of fair value accounting in 2012.

The industry witnessed the benefit of a lower tax regime in 2011, as the Government Budget proposals in 2010 announced significant reductions in corporate tax rates applicable for banks. Accordingly, the corporate tax charge for HNB dropped by 3.1% reflecting an effective tax rate of 28.3% compared to 33.7% in 2010.

In 2011, HNB managed to grow its pre-tax profits by 15.4% to Rs. 7.8 billion compared to the previous year, while the Group posted a pre-tax profit of Rs. 8.5 billion, recording a growth of 17%.

The net profit after tax for the bank stood at Rs. 5.6 billion, recording a growth of 24.8 % in 2011 despite pressure on margins and significant reduction in investment income as explained above. The Group net profit for 2011 amounted to Rs. 6.2 billion, which represents a year-on-year growth of 27.6%.

The bank’s return on average assets stood at 1.6% compared to 1.5% in the previous year and return on average equity was maintained at 17.3% in 2011 despite the equity infusion.

In 2011, the bank’s asset base grew by a significant 20.4% funded by an infusion of capital as well as a steady growth of its deposit base. Contrary to the previous two years, the loan book of the bank grew by a staggering 25.8% to Rs. 264.3 b. The growth was supported by all segments including corporate, SME, leasing, pawning and retail aided by the bank’s customer centre network spread across the country. The network expansion during the year, especially in the previous war torn regions too contributed towards this end.

Though the bank witnessed a robust growth in deposits of 21.4%, it did not keep pace with loans and advances. The current account base for the bank showed a drop from the previous year, mainly due to the withdrawal of a large deposit which came in for a short period of time during the last week of 2010.

The savings deposit base witnessed a healthy growth during the year despite increasing interest rates towards the latter part of the year adding pressure on low cost deposits. The rupee fixed deposits during the year witnessed a sizable growth of 45% to Rs. 113.3 b in 2011. Accordingly, the Current Account and Savings Account (CASA) ratio dropped from 56% in 2010 to 49% in 2011.

The bank paid an interim dividend of Rs. 1.50 per share for 2011 in December and proposes a final dividend of Rs. 6 per share. The final dividend consists of cash dividend of Rs. 3 per share and a scrip dividend of Rs. 3 per share. The gross dividend for the year increased by 76.7% to Rs. 2,914 million on account of the total dividend payment of Rs. 7.50 per share against the total gross dividend payment for 2010.

During the year the bank raised Rs. 6.1 billion by way of a rights issue while the tier II capital base was strengthened through a subordinated debt issue of Rs. 2 billion during the year. As a result, the capital adequacy ratios remained healthy with core capital ratio at 12.76% and total capital adequacy ratio at 14.51% as at the end of December 2011.

The Group companies recorded commendable contributions during 2011, with HNB Assurance PLC, the insurance subsidiary, posting a 24% growth in gross written premium and 14% growth in post-tax profits to reach Rs. 275 million.

Sithma Development Limited, the property development subsidiary, recorded outstanding performance in 2011, posting a growth of 60% in post-tax profit, while Acuity Partners (Pvt) Ltd., the joint venture investment bank, posted commendable results despite sluggish market conditions that prevailed during most part of the year.

The Acuity Group further consolidated its position as the full service investment bank in the country through the asset management arm that was set up during the year, in collaboration with Ceylon Guardian Investments PLC.

source - www.ft.lk

Singer Sri Lanka ends 2011 with Rs. 22 b revenue; profits up 95%

Singer Sri Lanka has capped a strong 2011 financial year by recording the most successful quarter yet in the Group’s history.

The consumer giant’s CEO Asoka Pieris noted that the Group’s revenues for 2011 reached Rs. 22 billion, while its net profit grew by 95% – remarkable figures that underscored the Group’s popularity with Sri Lankan consumers.

Singer Sri Lanka’s performance is even more noteworthy when the Group’s Rs. 150.5 million net gain on dilution in the previous year, attributed to Singer Finance’s IPO, is excluded. If this gain is set aside, the Group’s net profit growth over the prior year is a staggering 152%.

The Group’s fourth quarter growth was consistently strong with Singer (Sri Lanka) PLC notching a 38% increase in revenue while Singer Finance revenue rose by 27%.

Overall Group revenue grew by 37% in the fourth quarter, buoyed by strong consumer demand for its innovative products and services.

The Group’s outstanding results for the year were driven by the increasingly strong bond it shares with consumers, which were reflected in a surge in unit sales. Unit sales of televisions increased by 56% over the same period of the preceding year, while sales of refrigerators, washing machines, and audio equipment improved by 35%, 36%, and 36% respectively.

Other product lines that showed outstanding growth included computers (49%), air-conditioners (109%), small kitchen appliances (62%) and fans (87%).

Singer Sri Lanka offers customers an unrivalled degree of choice in these product categories and others, reflecting its commitment to a multi-brand marketing strategy. The Group leverages the country’s most extensive retail network to give customers the freedom of shopping at a conveniently close location.

Paired with the industry’s most widespread service network, Singer Sri Lanka is able to offer its customers an unbeatable value proposition. As the Group sets its sights on new heights, it is confident that it will be able to continually enhance its product and service offerings, enabling it to secure sustained success in the future.

source - www.ft.lk

The consumer giant’s CEO Asoka Pieris noted that the Group’s revenues for 2011 reached Rs. 22 billion, while its net profit grew by 95% – remarkable figures that underscored the Group’s popularity with Sri Lankan consumers.

Singer Sri Lanka’s performance is even more noteworthy when the Group’s Rs. 150.5 million net gain on dilution in the previous year, attributed to Singer Finance’s IPO, is excluded. If this gain is set aside, the Group’s net profit growth over the prior year is a staggering 152%.

The Group’s fourth quarter growth was consistently strong with Singer (Sri Lanka) PLC notching a 38% increase in revenue while Singer Finance revenue rose by 27%.

Overall Group revenue grew by 37% in the fourth quarter, buoyed by strong consumer demand for its innovative products and services.

The Group’s outstanding results for the year were driven by the increasingly strong bond it shares with consumers, which were reflected in a surge in unit sales. Unit sales of televisions increased by 56% over the same period of the preceding year, while sales of refrigerators, washing machines, and audio equipment improved by 35%, 36%, and 36% respectively.

Other product lines that showed outstanding growth included computers (49%), air-conditioners (109%), small kitchen appliances (62%) and fans (87%).

Singer Sri Lanka offers customers an unrivalled degree of choice in these product categories and others, reflecting its commitment to a multi-brand marketing strategy. The Group leverages the country’s most extensive retail network to give customers the freedom of shopping at a conveniently close location.

Paired with the industry’s most widespread service network, Singer Sri Lanka is able to offer its customers an unbeatable value proposition. As the Group sets its sights on new heights, it is confident that it will be able to continually enhance its product and service offerings, enabling it to secure sustained success in the future.

source - www.ft.lk

Bourse down despite Rs. 5 bn. Aitken Spence deal

Insurance Corp. sells out to Melstacorp

The Colombo bourse declined yesterday for the second consecutive day despite a Rs.5 billion deal where Sri Lanka Insurance Corporation (SLIC) sold its long held stake in Aitken Spence at Rs.115 per share to Melstacorp Limited, a 100% subsidiary of the Distilleries Company of Sri Lanka.

The market closed with the All Share Price Index dropping 44.92 points (0.82%) and the Milanka down 33.96 points (0.71%) on a turnover of Rs.5.86 billion, up from the previous day’s Rs.616 million, with 124 losers comfortably outpacing 72 gainers.

Brokers and analysts said that the market was unable to sustain the previous week’s rally that ended a protracted slump.

"Most of the day the turnover was around the Rs.170 million range until the big deal went through in early afternoon trading," a broker said. "Other than for the Spence transaction and some big trades in Ascot Holdings and PC House, the market was virtually dead."

The General and Life Funds of the SLIC sold their Spence stakes by crossings – the General Fund selling slightly over 26 million shares (6.14%) and the Life Fund 18 million shares (4.43%).

SLIC was the fourth biggest shareholder of Aitken Spence and broking circles said that these shares had been available for some time. The deal went through above the Rs.112.83 mandatory offer by Melstacorp for Spence that is pending right now.

A total of 1.6 million Ascot was transacted at Rs.225, up Rs.47.20 from its previous close. The share however closed at Rs.206.40, gaining Rs.28.60.

A total of 5.2 million PC House was traded yesterday closing flat at Rs.10.90. Brokers said that Acme Printing and Packaging was also heavily traded gaining 50 cents to close at Rs.27.10.

source - www.island.lk

The Colombo bourse declined yesterday for the second consecutive day despite a Rs.5 billion deal where Sri Lanka Insurance Corporation (SLIC) sold its long held stake in Aitken Spence at Rs.115 per share to Melstacorp Limited, a 100% subsidiary of the Distilleries Company of Sri Lanka.

The market closed with the All Share Price Index dropping 44.92 points (0.82%) and the Milanka down 33.96 points (0.71%) on a turnover of Rs.5.86 billion, up from the previous day’s Rs.616 million, with 124 losers comfortably outpacing 72 gainers.

Brokers and analysts said that the market was unable to sustain the previous week’s rally that ended a protracted slump.

"Most of the day the turnover was around the Rs.170 million range until the big deal went through in early afternoon trading," a broker said. "Other than for the Spence transaction and some big trades in Ascot Holdings and PC House, the market was virtually dead."

The General and Life Funds of the SLIC sold their Spence stakes by crossings – the General Fund selling slightly over 26 million shares (6.14%) and the Life Fund 18 million shares (4.43%).

SLIC was the fourth biggest shareholder of Aitken Spence and broking circles said that these shares had been available for some time. The deal went through above the Rs.112.83 mandatory offer by Melstacorp for Spence that is pending right now.

A total of 1.6 million Ascot was transacted at Rs.225, up Rs.47.20 from its previous close. The share however closed at Rs.206.40, gaining Rs.28.60.

A total of 5.2 million PC House was traded yesterday closing flat at Rs.10.90. Brokers said that Acme Printing and Packaging was also heavily traded gaining 50 cents to close at Rs.27.10.

source - www.island.lk

Tuesday, February 28, 2012

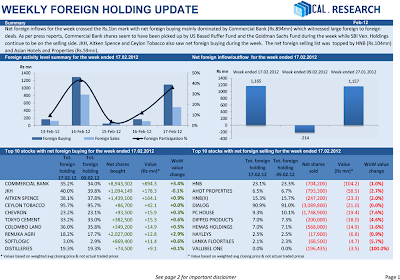

Foreign net inflow tops Rs. 3 billion

Locals may be having fears of the Geneva outcome but the very investors from the West are continuing to be bullish with net inflow topping the Rs. 3 billion mark by yesterday.

Foreigners were net buyers to the tune of Rs. 224 million increasing the net inflow under just two months of the year to Rs. 3.16 billion. Though small it is a record high and significant since for three years beginning 2009, the Colombo Bourse has seen a consecutive outflow.

Among stocks favoured by foreign funds yesterday were Ceylon Tobacco (Rs. 63 million), Sampath Bank (Rs. 61 million), Aitken Spence Hotels (Rs. 52 million) and Royal Ceramics (Rs. 16 million) whilst there was also buying in to JKH and Chevron Lubricants.

As part of trading Captains were largely on the selling side of Sampath as well as Commercial Bank whilst state funds EPF and ETF were active yesterday as well collecting banking and other blue chips.

Sampath, CTC, Aitken Spence Hotel Holdings and Royal Ceramics figured among the top five turnover contributors.

Analysts said average local investors were either selling out or on the sidelines awaiting the developments of the Human Rights Council sessions on Sri Lanka at the United Nations in Geneva whilst others blamed the inaction to problems associated with the Automated Trading System (ATS) version seven, as well as profit taking.

Ending 11 successive positive sessions, the stock market dipped by 1.6% yesterday whilst turnover was Rs. 616 million.

“The fall is due to profit-taking, but a number of investors have complained they can’t access the system via the internet after the stock exchange upgraded its trading system,” Acuity Stockbrokers Prashan Fernando was quoted as saying by Reuters.

Arrenga Capital said the bourse lost steam after seven consecutive days of gains with the approach of the month end margin calls and profit taking by investors.

The benchmark index had jumped over 550 points during the past seven days. The selling pressure during the day led to a decline in activity levels while the turnover was boosted by 3 off-market deals in blue-chip counters.

“In line with our expectations the sharp gains in the past week built up selling pressure with some investors looking to take profit. We believe the bourse is likely to continue to decline in next couple of days bringing back selected counters to attractive prices. Thus, we advise our investors accumulate on a decline market as we believe that at 5,200 level market valuations seem in line with peer markets,” Arrenga said.

Bukit Darah, Selinsing and Ceylon Beverage Holdings were the largest contributors to the decline of the index, which some linked to anomalies of ATS Version 7.

source - www.ft.lk

Foreigners were net buyers to the tune of Rs. 224 million increasing the net inflow under just two months of the year to Rs. 3.16 billion. Though small it is a record high and significant since for three years beginning 2009, the Colombo Bourse has seen a consecutive outflow.

Among stocks favoured by foreign funds yesterday were Ceylon Tobacco (Rs. 63 million), Sampath Bank (Rs. 61 million), Aitken Spence Hotels (Rs. 52 million) and Royal Ceramics (Rs. 16 million) whilst there was also buying in to JKH and Chevron Lubricants.

As part of trading Captains were largely on the selling side of Sampath as well as Commercial Bank whilst state funds EPF and ETF were active yesterday as well collecting banking and other blue chips.

Sampath, CTC, Aitken Spence Hotel Holdings and Royal Ceramics figured among the top five turnover contributors.

Analysts said average local investors were either selling out or on the sidelines awaiting the developments of the Human Rights Council sessions on Sri Lanka at the United Nations in Geneva whilst others blamed the inaction to problems associated with the Automated Trading System (ATS) version seven, as well as profit taking.

Ending 11 successive positive sessions, the stock market dipped by 1.6% yesterday whilst turnover was Rs. 616 million.

“The fall is due to profit-taking, but a number of investors have complained they can’t access the system via the internet after the stock exchange upgraded its trading system,” Acuity Stockbrokers Prashan Fernando was quoted as saying by Reuters.

Arrenga Capital said the bourse lost steam after seven consecutive days of gains with the approach of the month end margin calls and profit taking by investors.

The benchmark index had jumped over 550 points during the past seven days. The selling pressure during the day led to a decline in activity levels while the turnover was boosted by 3 off-market deals in blue-chip counters.

“In line with our expectations the sharp gains in the past week built up selling pressure with some investors looking to take profit. We believe the bourse is likely to continue to decline in next couple of days bringing back selected counters to attractive prices. Thus, we advise our investors accumulate on a decline market as we believe that at 5,200 level market valuations seem in line with peer markets,” Arrenga said.

Bukit Darah, Selinsing and Ceylon Beverage Holdings were the largest contributors to the decline of the index, which some linked to anomalies of ATS Version 7.

source - www.ft.lk

Bourse down on profit taking, unreliable prices

* Traders opt out for a while due to new system

Profit taking pulled down the Colombo Stock Exchange yesterday (Feb. 27) after about a week’s run on making positive gains as a new trading system has made it difficult to judge the true value of stocks, brokers said.

The All Share Price Index closed 89.71 points lower, down 1.61 percent to 5,476.59 points while the Milanka Price Index of more liquid stocks fell 1.03 percent, down 49.39 points to 4,753.39.

Turnover amounted to Rs. 616 million on 21.2 million shares changing hands during the day which saw 49 counters close in positive territory against 167 that closed in the red.

"We are of the opinion that the new trading system that is being implemented at the brokerages is causing traders to stay out of markets temporarily. This has led to some profit taking as we are unable to judge the true value of stocks. Spreads have widened and until the system runs at peak performance, we are unlikely to see much activity this week," Bartleet Religare Securities Technical Analyst Stefan Juriansz said.

"Technically the index seems to be finding some resistance at around 5,650. If we see the possibility of what the technicians refer to as a double bottom, that would only present us with a better opportunity to pick up strong investments. As discussed last week we are keeping an eye on certain value counters such at JKH, SAMP and VONE for index direction and the opportunity to enter into such securities," he said.

"All nine of the world’s worst-performing equity indexes this year are in frontier countries. This was due to the fact that the larger, more liquid markets offered relatively more compelling investment opportunities. However now Bank Julius Baer & Co. says the losses create buying opportunities for long-term investors and advise clients to look for quality as opposed to underperformance," Juriansz said.

As at January 16, 2012, the Colombo Stock Exchange was the second worst performing market in the world.

Foreign purchases continued to be positive with a net inflow of Rs. 224.4 million during the day.

source - www.island.lk

Profit taking pulled down the Colombo Stock Exchange yesterday (Feb. 27) after about a week’s run on making positive gains as a new trading system has made it difficult to judge the true value of stocks, brokers said.

The All Share Price Index closed 89.71 points lower, down 1.61 percent to 5,476.59 points while the Milanka Price Index of more liquid stocks fell 1.03 percent, down 49.39 points to 4,753.39.

Turnover amounted to Rs. 616 million on 21.2 million shares changing hands during the day which saw 49 counters close in positive territory against 167 that closed in the red.

"We are of the opinion that the new trading system that is being implemented at the brokerages is causing traders to stay out of markets temporarily. This has led to some profit taking as we are unable to judge the true value of stocks. Spreads have widened and until the system runs at peak performance, we are unlikely to see much activity this week," Bartleet Religare Securities Technical Analyst Stefan Juriansz said.

"Technically the index seems to be finding some resistance at around 5,650. If we see the possibility of what the technicians refer to as a double bottom, that would only present us with a better opportunity to pick up strong investments. As discussed last week we are keeping an eye on certain value counters such at JKH, SAMP and VONE for index direction and the opportunity to enter into such securities," he said.

"All nine of the world’s worst-performing equity indexes this year are in frontier countries. This was due to the fact that the larger, more liquid markets offered relatively more compelling investment opportunities. However now Bank Julius Baer & Co. says the losses create buying opportunities for long-term investors and advise clients to look for quality as opposed to underperformance," Juriansz said.

As at January 16, 2012, the Colombo Stock Exchange was the second worst performing market in the world.

Foreign purchases continued to be positive with a net inflow of Rs. 224.4 million during the day.

source - www.island.lk

Asia Capital begins construction of two luxury hotels

The Asia Capital Group said the construction of a 30 room hotel property, ‘Taprobana,’ has begun in Balapitiya and is expected to be completed in time for summer 2013. It said work had also begun on another 30 room property in Wadduwa, situated in a prime beachfront location which will be opened simultaneously.

"Asia Leisure owns and operates three properties, The Park Street Hotel – Colombo, The River House – Balapitiya and The Tamarind Hill Hotel – Galle.The River House was the 1st ever Sri Lankan property to be featured in Conde Nast Traveller’s exclusive annual Hot List (2005) as one of the ‘Hottest’ new hotels in the world and Robb Report Recommended 100 Ultimate Luxury Escapes for the second consecutive year," Asia Capital said in a statement.

"Taprobana which will be registered under the Tourist Board of Sri Lanka will be located on a picturesque beachfront property. It is expected to compete with the other quality beach properties in the area. Using distinctive Asian influences, the hotel will be built on a ‘home away from home’ concept and will provide stylish, comfortable accommodation for discerning guests wanting to experience Sri Lanka’s beautiful beaches and hospitality.

"The hotel will boast all modern features including a spa, a healing and meditation centre near the beach, business centre, library, music room, swimming pool and meeting facilities conforming to international standards. The main restaurant will serve the best of gourmet specialties in fish and seafood for which the south coast is renowned for.

"The 30 room property in Balapitiya will include two luxury suites and due to

its unique structure and design the rooms will be in equal style while the suites will have extensive space. All rooms will overlook the beach with a wider view of the sea. Rooms will be equipped with state-of-the-art facilities including Wi-Fi, iPod connectors, LED HD TVs, mini bar and a spacious living area with balconies facing the ocean."

Speaking about the company’s investment in these properties Peter Jansen, Director of Asia Leisure said, "The leisure industry is expected to be the fourth largest foreign exchange earner for the country,evidenced by 2011 recording the highest ever tourist arrivals of 855,975. Given this rise in demand we feel that this is the ideal time to expand our string of properties, offering visitors a unique hotel experience."

The Wadduwa property situated on a prime beachfront land will all be suites which will boast of high ceilings and will have balconies with a sea view, among all other international standard amenities.

The hotel will boast a large swimming pool overlooking the Indian Ocean, an authentic fine dining restaurant and a gourmet garden restaurant. The spa operations will be conducted from an exclusive wing.

source - www.island.lk

"Asia Leisure owns and operates three properties, The Park Street Hotel – Colombo, The River House – Balapitiya and The Tamarind Hill Hotel – Galle.The River House was the 1st ever Sri Lankan property to be featured in Conde Nast Traveller’s exclusive annual Hot List (2005) as one of the ‘Hottest’ new hotels in the world and Robb Report Recommended 100 Ultimate Luxury Escapes for the second consecutive year," Asia Capital said in a statement.

"Taprobana which will be registered under the Tourist Board of Sri Lanka will be located on a picturesque beachfront property. It is expected to compete with the other quality beach properties in the area. Using distinctive Asian influences, the hotel will be built on a ‘home away from home’ concept and will provide stylish, comfortable accommodation for discerning guests wanting to experience Sri Lanka’s beautiful beaches and hospitality.

"The hotel will boast all modern features including a spa, a healing and meditation centre near the beach, business centre, library, music room, swimming pool and meeting facilities conforming to international standards. The main restaurant will serve the best of gourmet specialties in fish and seafood for which the south coast is renowned for.

"The 30 room property in Balapitiya will include two luxury suites and due to

its unique structure and design the rooms will be in equal style while the suites will have extensive space. All rooms will overlook the beach with a wider view of the sea. Rooms will be equipped with state-of-the-art facilities including Wi-Fi, iPod connectors, LED HD TVs, mini bar and a spacious living area with balconies facing the ocean."

Speaking about the company’s investment in these properties Peter Jansen, Director of Asia Leisure said, "The leisure industry is expected to be the fourth largest foreign exchange earner for the country,evidenced by 2011 recording the highest ever tourist arrivals of 855,975. Given this rise in demand we feel that this is the ideal time to expand our string of properties, offering visitors a unique hotel experience."

The Wadduwa property situated on a prime beachfront land will all be suites which will boast of high ceilings and will have balconies with a sea view, among all other international standard amenities.

The hotel will boast a large swimming pool overlooking the Indian Ocean, an authentic fine dining restaurant and a gourmet garden restaurant. The spa operations will be conducted from an exclusive wing.

source - www.island.lk

NDB Group profits up 35% to Rs. 2.9bn

The NDB Group’s Profit After Tax for the year ended December 31, 2011 was Rs 2.94 bn, up 35% over the previous year. The Profit Attributable to Shareholders for the year was 2.70 bn and compares with Rs 2.1 bn for 2010, a growth of 29%. This significant increase in group profits was attributable to the growth in the core banking income of NDB by 13% over the previous year and the improved performance of the fee based group companies, the bank announced.

NDB positions itself as the only Financial Services Group in the country, with subsidiaries and associates in Investment Banking, Stock Broking, and Wealth Management, which make up the Capital Markets cluster, and Insurance. The performance of the capital markets cluster improved significantly due to the increased level of activity, in particular managing complex IPOs, apart from a host of other Investment banking services it offers. Additionally, the investment banking arm in Bangladesh, NDB Capital, has performed well despite the difficult market conditions.

The Bank’s Net Interest Income grew by 18% over 2010, supported by a significant growth in loans and advances by 43% and customer deposits by 35%. The growth is commendable, and in relative terms NDB’s performance during the year was higher than its peers.

The Bank’s Profit After Tax, grew by 32% despite the relatively lower equity income during the year compared with 2010.

NDB has been able to contain its Non Performing Loans (NPL) ratio to an all time low of 1.35% which is one of the lowest in the industry. The Bank has been able to achieve this low level of delinquencies by the use of strong credit analysis techniques and proactive risk management practices. The provision cover on NPLs was at 74% as at 31 December 2011 with an Open Loan Position of 2.73%, which signify minimum amount of stress on the Bank’s equity, on account of un-provided delinquencies.

NDB is actively engaged in SME banking and has funded agriculture, handicrafts, manufacturing, trading & distribution, fisheries, and dairy sectors to develop the entrepreneurs in the country.

NDB Divi Aruna SME Loan Scheme was extended to most parts of the country in 2011 including the deep South and the East. Facilities were provided to fisheries, agriculture, dairy and other small scale industries. This scheme provides much needed capital with flexible repayment terms at an attractive pricing, with convenient accessibility. NDB also conducted capacity building workshops in identified areas of the country in an effort to enrich the knowledge base of SMEs

NDB is also actively engaged in Corporate Banking with primary concentration on import, export and infrastructure related businesses. Majority of the Corporate Banking customers of NDB use the electronic-banking platform to transact their business. Product features and facilities are regularly being added and enhanced to continuously improve accessibility, convenience and security.

In keeping abreast with the growth momentum created as a result of restoration of peace, the Project Finance Division diversified its portfolio into growth sectors such as Tourism, Healthcare, Rubber Products, Non-conventional Renewable Energy, Construction related sectors and Animal Husbandry.

The economic revival of the North and the East created unprecedented opportunities for project financing and NDB funded several projects. This also included hotel projects in Passekudah in the East, including a five-star hotel in the year 2011.

NDB has also made strong inroads into rural and urban parts of the country. The expansion plan with 13 branches in 2011 increased its foot print covering key geographies in the country. NDB continued to push its national savings drive, taking the core concept of ‘savings’ beyond monetary measures.

This savings drive was extended to all part of the country earlier in the year.

NDB launched some of the most innovative products in the year 2011. NDB introduced the breakthrough ‘Rattharan Savings’ product. The pioneering product offers a unique feature in which customers can reserve gold at today’s price and obtain gold for the future by paying in instalments.

The Bank revolutionised the leasing industry by introducing new benefits to its leasing product, where long traditional requirements of customers, to have guarantors or make a down payment, in order to obtain a lease facility are no longer required.

For the first time in the Sri Lankan banking history NDB introduced a loan approval within 3 hours for its Dream Maker Personal Loans. NDB also became the first bank in Sri Lanka to introduce secure, online shopping for debit cardholders with the introduction of the ‘Verified by Visa’ facility.

NDB Group has signed an MOU with Singapore’s DBS Bank, to form a strategic alliance in Investment Banking. Through this MOU, NDB Group and DBS Bank would work on Equity and Fixed Income Issuances, Syndications, Project Financing and Mergers & Acquisitions.

DBS Bank is the largest bank in Singapore and a leading financial services group in Asia.

NDB was presented a number of awards in the year including the award for excellence in branding and marketing at the CMO Asia Awards, the Bronze Award for its ‘Ithuru Karana Maga’ at the 2011 Effie Awards. In addition the bank emerged the proud recipient of an award presented at the prestigious National Business Excellence Awards and won two awards at the Best Corporate Citizens Awards 2011.The Bank emerged 2nd Runner Up - under the second main category at the Best Corporate Citizen Award 2011 for CSR and Sustainable Business, and was also recognized for the Special CSR Project carried out in the North and East, under the category of ‘Best CSR Projects’

NDB was once again positioned in the prestigious Business Today Top Twenty Awards ranking which recognizes the cream of Sri Lankan corporates for their exceptional performance throughout the past year.

In keeping with the bank’s commitment to provide high quality banking services, NDB implemented a new core banking IT platform in the last quarter of 2011. The IT platform is expected to significantly improve customer services and offer innovative services.

source - www.island.lk

NDB positions itself as the only Financial Services Group in the country, with subsidiaries and associates in Investment Banking, Stock Broking, and Wealth Management, which make up the Capital Markets cluster, and Insurance. The performance of the capital markets cluster improved significantly due to the increased level of activity, in particular managing complex IPOs, apart from a host of other Investment banking services it offers. Additionally, the investment banking arm in Bangladesh, NDB Capital, has performed well despite the difficult market conditions.

The Bank’s Net Interest Income grew by 18% over 2010, supported by a significant growth in loans and advances by 43% and customer deposits by 35%. The growth is commendable, and in relative terms NDB’s performance during the year was higher than its peers.

The Bank’s Profit After Tax, grew by 32% despite the relatively lower equity income during the year compared with 2010.

NDB has been able to contain its Non Performing Loans (NPL) ratio to an all time low of 1.35% which is one of the lowest in the industry. The Bank has been able to achieve this low level of delinquencies by the use of strong credit analysis techniques and proactive risk management practices. The provision cover on NPLs was at 74% as at 31 December 2011 with an Open Loan Position of 2.73%, which signify minimum amount of stress on the Bank’s equity, on account of un-provided delinquencies.

NDB is actively engaged in SME banking and has funded agriculture, handicrafts, manufacturing, trading & distribution, fisheries, and dairy sectors to develop the entrepreneurs in the country.

NDB Divi Aruna SME Loan Scheme was extended to most parts of the country in 2011 including the deep South and the East. Facilities were provided to fisheries, agriculture, dairy and other small scale industries. This scheme provides much needed capital with flexible repayment terms at an attractive pricing, with convenient accessibility. NDB also conducted capacity building workshops in identified areas of the country in an effort to enrich the knowledge base of SMEs

NDB is also actively engaged in Corporate Banking with primary concentration on import, export and infrastructure related businesses. Majority of the Corporate Banking customers of NDB use the electronic-banking platform to transact their business. Product features and facilities are regularly being added and enhanced to continuously improve accessibility, convenience and security.

In keeping abreast with the growth momentum created as a result of restoration of peace, the Project Finance Division diversified its portfolio into growth sectors such as Tourism, Healthcare, Rubber Products, Non-conventional Renewable Energy, Construction related sectors and Animal Husbandry.

The economic revival of the North and the East created unprecedented opportunities for project financing and NDB funded several projects. This also included hotel projects in Passekudah in the East, including a five-star hotel in the year 2011.

NDB has also made strong inroads into rural and urban parts of the country. The expansion plan with 13 branches in 2011 increased its foot print covering key geographies in the country. NDB continued to push its national savings drive, taking the core concept of ‘savings’ beyond monetary measures.

This savings drive was extended to all part of the country earlier in the year.

NDB launched some of the most innovative products in the year 2011. NDB introduced the breakthrough ‘Rattharan Savings’ product. The pioneering product offers a unique feature in which customers can reserve gold at today’s price and obtain gold for the future by paying in instalments.

The Bank revolutionised the leasing industry by introducing new benefits to its leasing product, where long traditional requirements of customers, to have guarantors or make a down payment, in order to obtain a lease facility are no longer required.

For the first time in the Sri Lankan banking history NDB introduced a loan approval within 3 hours for its Dream Maker Personal Loans. NDB also became the first bank in Sri Lanka to introduce secure, online shopping for debit cardholders with the introduction of the ‘Verified by Visa’ facility.

NDB Group has signed an MOU with Singapore’s DBS Bank, to form a strategic alliance in Investment Banking. Through this MOU, NDB Group and DBS Bank would work on Equity and Fixed Income Issuances, Syndications, Project Financing and Mergers & Acquisitions.

DBS Bank is the largest bank in Singapore and a leading financial services group in Asia.

NDB was presented a number of awards in the year including the award for excellence in branding and marketing at the CMO Asia Awards, the Bronze Award for its ‘Ithuru Karana Maga’ at the 2011 Effie Awards. In addition the bank emerged the proud recipient of an award presented at the prestigious National Business Excellence Awards and won two awards at the Best Corporate Citizens Awards 2011.The Bank emerged 2nd Runner Up - under the second main category at the Best Corporate Citizen Award 2011 for CSR and Sustainable Business, and was also recognized for the Special CSR Project carried out in the North and East, under the category of ‘Best CSR Projects’

NDB was once again positioned in the prestigious Business Today Top Twenty Awards ranking which recognizes the cream of Sri Lankan corporates for their exceptional performance throughout the past year.

In keeping with the bank’s commitment to provide high quality banking services, NDB implemented a new core banking IT platform in the last quarter of 2011. The IT platform is expected to significantly improve customer services and offer innovative services.

source - www.island.lk

NTB posts record profits