* What: Sri Lanka's January inflation release

* When: Monday, Jan. 31, around 3.00 p.m. (0930 GMT)

REUTERS FORECAST:

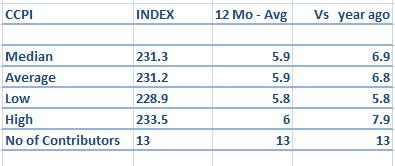

* Forecast: Both annual inflation and 12-month moving average inflation to have stabilised at 6.9 percent and 5.9 percent respectively, unchanged from December figures.

FACTORS TO WATCH:

01. Reasons for inflation stabilising. Many analysts said as in the past, the island nation's inflation figures may show

minimum changes from the previous month, despite high local and global food prices. The main opposition United National Party had said the index fails to reflect real consumer spending patterns. [ID:nSGE70J05K]

02. Impact of the recent floods on inflation. At least 21 percent of the Sri Lanka's staple rice crop has been destroyed and analysts expect a food shortage could threaten price stability, although the government has adequate stocks. [ID:nSGE70CB8P]

03. If there are signs of demand-driven inflation as the central bank surprisingly cut policy rates to six-year lows earlier this month. [ID:nSGE70A00Z]

04. Steps to curb inflation, with the post-war economy picking up and private sector credit growth expanding a more-than-expected 23.1 percent month-on-month in November in response to central bank monetary policy rate reductions. The central bank had originally expected private sector credit to grow at 15 percent by December. Sri Lanka's $50 billion economy is expected to have expanded around 8 percent last year.

05. Whether the central bank will use any tightening measures to curb possible demand-driven inflation.

06. Impact of 2011 budget proposals and relaxation of strict exchange rate controls on inflation and interest rates given the government's direction for private sector-led economic growth while agreeing to the IMF's budget deficit reduction path.

MARKET IMPACT:

01. If lower or unchanged inflation would be a welcome move for banks, which are still waiting corporate to borrow for expansions and new investments. On the other hand, corporates may take wait to see where official inflation moves amid the sharp rise in food and other commodity prices, despite low interest rates.

02. Low interest rates and low inflation will push more investors into the booming Colombo Stock Exchange .CSE, due to lower returns from fixed income instruments.

Following is the poll's forecast for the January inflation data due to be released on Monday: (Inflation figures are in percent)

Note: The following contributors participated in the poll:

Commercial Bank of Ceylon, HSBC, National Development Bank (NDB), Hatton National Bank (HNB), Bank of Ceylon, Citi Bank, CT Smith Research, TKS Securities, People's Bank, Asia Securities, Standard Chartard Bank, Nations Trust Bank, Deutsche Bank, and FCT Smith Research.

(Reporting by Shihar Aneez; Editing by Bryson Hull)

source - in.reuters.com

No comments:

Post a Comment