Sri Lanka stock picks site has been developed to give first hand information with regard to share trading opportunities available for investors who do not like go through lengthy research reports, calculations,etc but to have a clear idea about stocks that have future up side potential.Our service is just not for day traders but for the investors who wish to see their money growing in the long run.Our main objective is to provide information relating to trading under one roof.

Monday, October 8, 2012

Weekly Market Review

All three indices declined over the week with the ASPI losing 92.30 points (or 1.55%) to close the week at 5879.69 points. The MPI declined 3.18% (or 179.45) points while the S&P SL 20 Index lost 70.84 points with a decline of 2.19%. The MPI closed at 5466.50 points while the S&P SL 20 Index closed at 3170.14 points.

Large crossings of Sampath Bank which took place mid-week resulted in the counter contributing the most to the week’s total turnover value, accounting for 28.55% (or LKR 1.70bn) of the market’s overall turnover value. LOLC accounted for a value of LKR 590.73mn or 9.90% while JKH contributed 7.90% with a value of LKR 471.35mn to the market’s total turnover value. The week’s total turnover summed up to LKR 5.97bn, a decrease of 40.56% from last week’s value of LKR 10.04bn. The daily average turnover value for the week amounted to LKR 1.19bn relative to last week’s LKR 2.01bn. Market capitalization decreased by LKR 32.94bn (or 1.44%) to LKR 2251.94bn, relative to last week’s market capitalization of LKR 2284.88bn.

The Banking and Finance sector - aided mostly by Sampath Bank (with a value of LKR 1.70bn) - was the highest contributor to the week’s turnover value, contributing LKR 3.11bn or 52.06% to the market. The Diversified sector accounted for LKR 922.50mn or 15.46% while the Beverage Food and Tobacco sector contributed 6.77% with a value of LKR 403.75mn to the market’s total turnover value.

The highest contributor to total market turnover volume this week was the Banking and Finance sector accounting for 32.18% as 58.88mn shares changed hands. The Diversified sector followed suit, contributing 12.15% to the market as 22.22mn shares changed hands. The Telecommunication sector meanwhile contributed 12.05% to total market volume as 22.04mn shares were traded over the week.

The top price gainers for the week was led by Bimputh Finance with an increase of 22.86% to close the week at LKR 34.40 from its previous week’s close of LKR 28.00. Colombo Investment Trust gained 15.11% to close at LKR 144.00 while Good Hope closed at LKR 1390.00, gaining 14.88% over the week.

SMB Leasing [NV] declined 20.00% from its previous week’s close of LKR 0.50 to close the current week at LKR 0.40. Paragon Ceylon lost 15.74% to close the week at LKR 1150.00 while G S Finance dropped 13.55% to close the week at LKR 802.00.

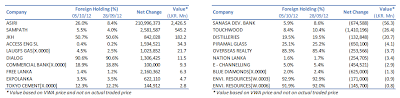

Foreign investors yet again closed the week as net buyers with net inflows amounting to LKR 0.77bn relative to LKR 1.42bn last week, representing a 45.75% W-o-W decline. Daily average net inflows amounted to LKR 0.15bn relative to LKR 0.28bn recorded last week. Total foreign purchases declined 24.82% to LKR 1.86bn from LKR 2.47bn last week, while total foreign sales amounted to LKR 1.09bn relative to LKR 1.05bn last week representing a 3.45% W-o-W gain. In terms of volume, Asiri Hospitals Holdings and Sampath Bank led foreign purchases, while Touchwood and Sanasa Development Bank led the foreign sales. In terms of value too, Asiri Hospital Holdings and Sampath Bank led foreign purchases, while Sanasa Development Bank and Touchwood led foreign sales.

source - acuity stock brokers

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment